News

News

LOS ANGELES, Nov. 6, 2014 /PRNewswire/ -- B. Riley Financial, Inc. (the "Company" or "B. Riley Financial") (OTCBB:RILY), f/k/a Great American Group, Inc., today announced financial results for its third quarter ended September 30, 2014. B. Riley Financial is a diversified financial services firm; through its wholly-owned subsidiaries, B. Riley & Co., LLC, which provides a full array of investment banking, equity research, and sales & trading services to corporate, institutional and high net worth investors, and Great American Group, LLC, a leading provider of asset disposition services, advisory and valuation services, commercial lending, and real estate advisory services, B. Riley Financial offers clients unique and collaborative solutions for a myriad of situations.

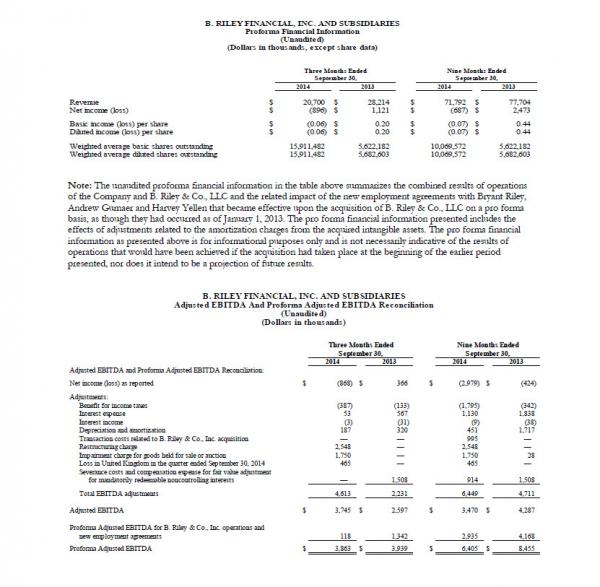

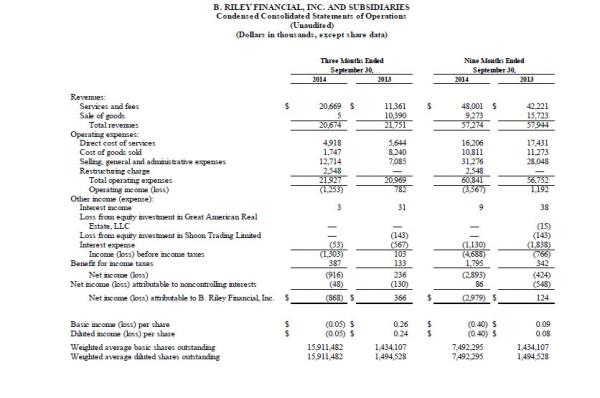

For the third quarter ended September 30, 2014, the Company reported total revenues of $20.7 million, a decrease from $21.8 million in the third quarter of 2013. B. Riley Financial also reported Adjusted EBITDA of $3.7 million in the third quarter of 2014, an increase from $2.6 million in the third quarter of 2013. For the third quarter of 2014, net loss was $0.9 million compared to net income of $0.4 million for the third quarter of 2013 reflecting the effects of the restructuring efforts. Diluted net loss per share was $(0.05) in the third quarter of 2014 compared to diluted net income per share of $0.24 in the third quarter of 2013.

"We just completed the first quarter of the combined operations of B. Riley & Co. and Great American Group. B. Riley & Co. had a productive quarter and contributed $9.5 million to our quarterly revenues. In addition, one of our primary goals under the new B. Riley Financial banner has been to identify opportunities where, working collaboratively, we can leverage the expertise found across all of our businesses," said Bryant Riley, Chairman and CEO of B. Riley Financial. "These efforts have led to several successful projects for us, including new retail liquidation engagements for Love Culture, Naartjie Kids and the stalking horse bid for the liquidation of ALCO stores." Mr. Riley continued, "We have also taken significant restructuring measures across several of our businesses in the third quarter. We believe that these measures will help us to reduce our fixed operating expenses and enable us to operate in a leaner fashion going forward."

Business Highlights

Highlights from various business segments in the third quarter include:

- B. Riley & Co. businesses had a strong quarter with revenues of $9.5 million, up 48% from the same period in the prior year. Investment banking revenues of $5.1 million were up 115% and equity commission revenues of $3.3 million were up 5% from the same period in the prior year.

- Strong performance of the Valuation and Appraisal segment with revenue of $7.8 million, an increase of 14% from prior year's quarter.

- Auction and Liquidation segment revenue of $3.4 million for the third quarter. While liquidation revenue for the quarter was light, cross selling efforts between B. Riley & Co. and Great American Group are yielding an increase in the number of liquidation opportunities.

- Initiative underway to stimulate opportunities for cross-selling of services across the collection of B. Riley & Co. and Great American Group client base.

- Strategic review of operations led to restructuring measures implemented in the third quarter. Restructuring measures included, among other things, a reduction in force, the restructuring of European operations, and the closure of an office in Deerfield, Illinois.

In the third quarter of 2014, the Company recorded a previously announced restructuring charge of $2.5 million as a result of a strategic review of its operations after taking into account the planned synergies from the acquisition of B. Riley & Co. The Company also recorded a non-cash impairment charge of $1.75 million to costs of goods sold to reduce the carrying value of certain goods held for sale or auction in the third quarter.

Parent Company Name Change and Stock Ticker Change

As previously announced, the Company was renamed B. Riley Financial, Inc. from Great American Group, Inc. The name change follows other events resulting from the recent combination of Great American Group, Inc. and B. Riley & Co., LLC. Additionally, the Company will trade on the OTCBB under the new ticker symbol of "RILY" at the commencement of trading on November 7, 2014. Neither the name change nor the ticker symbol change requires any action by existing stockholders. Outstanding stock certificates will not be affected by such changes and do not need to be exchanged.

Declaration of Dividend

Going forward, the Company intends to distribute a portion of net profits to our stockholders in the form of dividends as determined by the Board of Directors. Given the volatile nature of our business activity and operating results, the Board intends to evaluate the declaration of dividends on a quarter by quarter basis based on operating performance, outlook and other factors deemed relevant by the Board. Our Board of Directors approved a dividend of $0.03 per share, which will be paid on or about December 9, 2014 to stockholders of record on November 18, 2014.

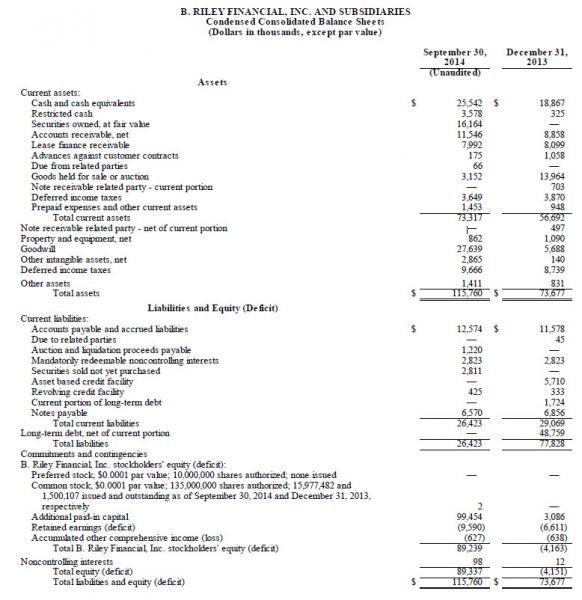

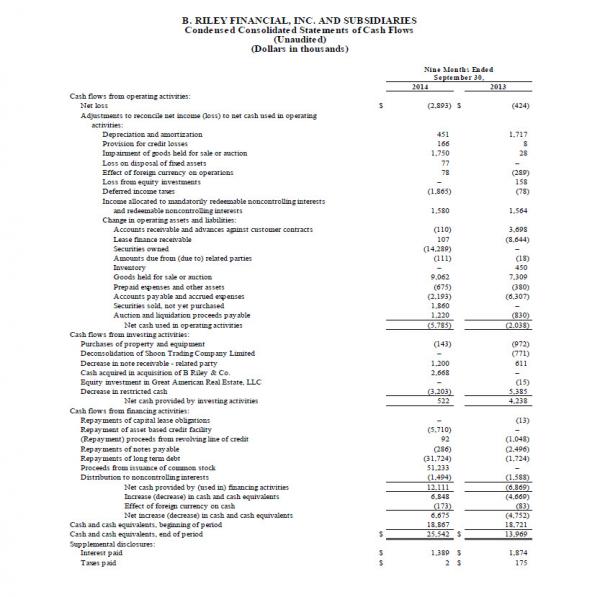

Financial Position

As of September 30, 2014, we had $25.5 million of unrestricted cash, $3.6 million of restricted cash, and net investments in securities of $13.4 million. Total stockholder equity as of September 30, 2014 was $89.2 million as a result of the private placement of common stock completed in June 2014, the issuance of common stock for the acquisition of the B. Riley entities, and measures taken to retire the Promissory Notes payable to the former Great American Group members.

Conference Call

The Company will host a conference call today at 4:30 p.m. ET to discuss results for the third quarter ended September 30, 2014. To participate in the event by telephone, please dial 855-327-6837, 10 minutes prior to the start time (to allow time for registration). International callers should dial +1 631-982-4565. A replay will be available beginning November 6, 2014, at 7:30 p.m. ET, through November 13, 2014, at 11:59 p.m. ET. To access the replay, please dial 877-870-5176 (U.S.), and use passcode 111837. International callers should dial +1 858-384-5517 and enter the same passcode.

The call will also be broadcast over the Internet and can be accessed on the Investor Relations section of the Company's website at www.brileyfin.com. A replay of the call will also be available for 90 days on the website.

About B. Riley Financial, Inc. (OTCBB:RILY)

B. Riley Financial, Inc. (OTCBB:RILY) offers a full array of financial and advisory services through several wholly-owned subsidiaries. B. Riley & Co., LLC is a FINRA-registered, leading investment bank which provides corporate finance, research, and sales & trading to corporate, institutional and high net worth individual clients. Great American Group, LLC is a leading provider of advisory and valuation services, asset disposition and auction solutions, commercial lending and real estate advisory services. B. Riley Asset Management is a SEC-registered investment advisor which provides investment management and financial advisory services.

B. Riley Financial is headquartered in Los Angeles with offices in Atlanta, Boston, Charlotte, N.C., Chicago, Dallas, Melville and New York, N.Y., Newport Beach, Norwalk, Conn., San Francisco, and Munich.

For more information about B. Riley Financial, please visit www.brileyfin.com or call 310-689-5235.

Forward-Looking Statements

This press release may contain forward-looking statements by B. Riley Financial that are not based on historical fact, including, without limitation, statements containing the words "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions and statements and include statements regarding the effects of our recent restructuring, future dividends and our intent to stimulate opportunities for cross-selling of services. Because these forward-looking statements involve known and unknown risks and uncertainties, there are important factors that could cause actual results, events or developments to differ materially from those expressed or implied by these forward-looking statements. Such factors include our ability to successfully integrate recent acquisitions, loss of key personnel, our ability to manage growth, the potential loss of financial institution clients, our ability to reduce operating expenses as a result of recent restructuring, and those risks described from time to time in B. Riley Financial's filings with the SEC, including, without limitation, the risks described in B. Riley Financial's (f/k/a Great American Group, Inc.) registration statement on Form S-1 proxy statement/prospectus filed with the SEC on September 18, 2014, under the caption "Risk Factors", and its Annual Report on Form 10-K for the year ended December 31, 2013 under the captions "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations". Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2014. These factors should be considered carefully and readers are cautioned not to place undue reliance on such forward-looking statements. All information is current as of the date this press release is issued, and B. Riley Financial undertakes no duty to update this information.

Note Regarding Use of Non-GAAP Financial Measures

Certain of the information set forth herein, including Adjusted EBITDA, may be considered non-GAAP financial measures. B. Riley Financial believes this information is useful to investors because it provides a basis for measuring the performance of the Company on a combined basis with B. Riley & Co. In addition, the Company's management uses these non-GAAP financial measures along with the most directly comparable GAAP financial measures in evaluating the Company's operating performance, capital resources and cash flow. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-financial measures as reported by the Company may not be comparable to similarly titled amounts reported by other companies. The accompanying tables have more details on the non-GAAP financial measures that are most directly comparable to GAAP financial measures and the related reconciliations between these financial measures.

Investor Contact:

B. Riley Financial

Phillip Ahn

Chief Financial Officer & Chief Operating Officer

818-884-3737